New ADA (Americans with Disabilities Act) regulations will take effect March 15, 2012. I’ve been meaning to write about this topic for some time. Most (close to 100%) of the commercial real estate owners I mention this to are completely unaware that the new regs are coming.The complete copy of the act and supplemental material can be found at Revised ADA Regulations Implementing Title II and Title III.

The new regulations affect virtually every commercial building open to the public, including establishments that were exempted in the original 1991 act, and facilities such as office buildings, factories and warehouses that do not provide goods or services directly to the public are subject to the ADA’s requirements for new construction and alterations. The new act was passed by Congress in 2010, and phased the enactment of the anti-discriminatory hiring sections for March 15, 2011, and the building accessibility standards for this year.

Most importantly, the new act eliminates the “grandfather” or “safe harbor” provision that exempted buildings constructed prior to 1991 from compliance with ADA unless significant alterations or new construction occurs. After March 15, 2012 all buildings must comply with the 2010 standards when making improvements previously considered normal maintenance or replacement.

Most importantly, the new act eliminates the “grandfather” or “safe harbor” provision that exempted buildings constructed prior to 1991 from compliance with ADA unless significant alterations or new construction occurs. After March 15, 2012 all buildings must comply with the 2010 standards when making improvements previously considered normal maintenance or replacement.

Quoting from the ADA Small Business Primer:

“When a small business undertakes an alteration to any of its facilities, it must, to the maximum extent feasible, make the alteration accessible. An alteration is defined as remodeling, renovating, rehabilitating, reconstructing, changing or rearranging structural parts or elements, changing or rearranging plan configuration of walls and full-height partitions, or making other changes that affect (or could affect) the usability of the facility.”

“Examples include restriping a parking lot, moving walls, moving a fixed ATM to another location, installing a new sales counter or display shelves, changing a doorway entrance, replacing fixtures, flooring or carpeting. Normal maintenance, such as reroofing, painting, or wallpapering, is not an alteration.”

The one that got our attention was the classification of flooring and carpeting, and parking lot restriping as alterations that require compliance with new standards.

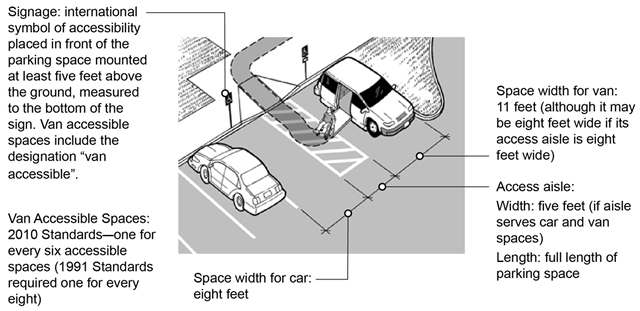

The new act requires 1 van accessible space per 6 required handicapped spaces, a change from 1 per 8 spaces previously required. This affects parking lots with 151 or more spaces. A van space requires 11′ wide parking space adjacent to an 5′ wide access aisle, or an 8′ wide space if the access aisle is 8′ wide, as depicted below.

In practice, assuming the typical requirement for 1 parking pace per 200 sq. ft. (5 per 1,000 sf) for retail uses, this will affect retail centers of 30,000 square feet and up. This is an important consideration when assessing needed capital expenditures during acquisition due diligence, or in budgeting for existing properties. Essentially every parking lot over this size is now non-compliant, as all local building codes are written in compliance with the 1991 act. Unless sufficient space is available to accommodate additional van spaces the center could be unable to get a certificate of occupancy for new tenants after improvements are made. Typical office parking requirements are 1 space per 400 sq. ft., so the new requirement will kick in for buildings over 60,000 sq. ft.

New carpeting or flooring can trigger requirements for a minimum 3′ wide accessible route through public space (e.g. retail display shelving, showrooms, office areas, etc.), heights of counters and light switches.

The new standards still contain the “readily achievable” language of the original act. This is a subjective judgment made by a local building official which is supposed to take into account business size, relative affordability, and the nature of the barrier or non-accessible feature in determining whether the new requirement can be met.

The act does provide that compliance costs are tax deductible. Section 190 of the IRS Code provides a tax deduction for businesses of all sizes for costs incurred in removing architectural barriers in existing facilities or alterations. The maximum deduction is $15,000 per year. For businesses with less than $1 million in revenue and fewer than 30 employees, all costs of compliance are deductible.

However, the tax deduction is going to be cold comfort for building owners struggling to maintain rent rolls. Office and retail tenants routinely demand new carpeting for renewals, some leases require it every few years. And parking lot striping is a recurring maintenance expense every five years or so. You may want to take a look at your parking lots now, and if they are close to needing sealing get it done now. Ditto with lease renewals requiring improvements.